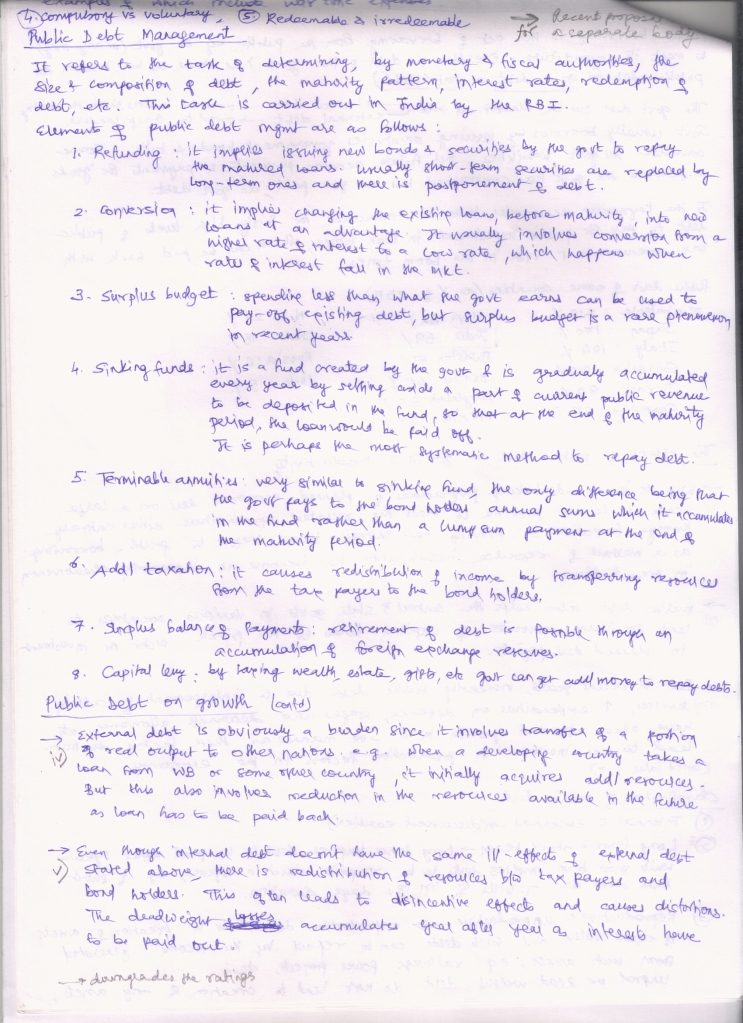

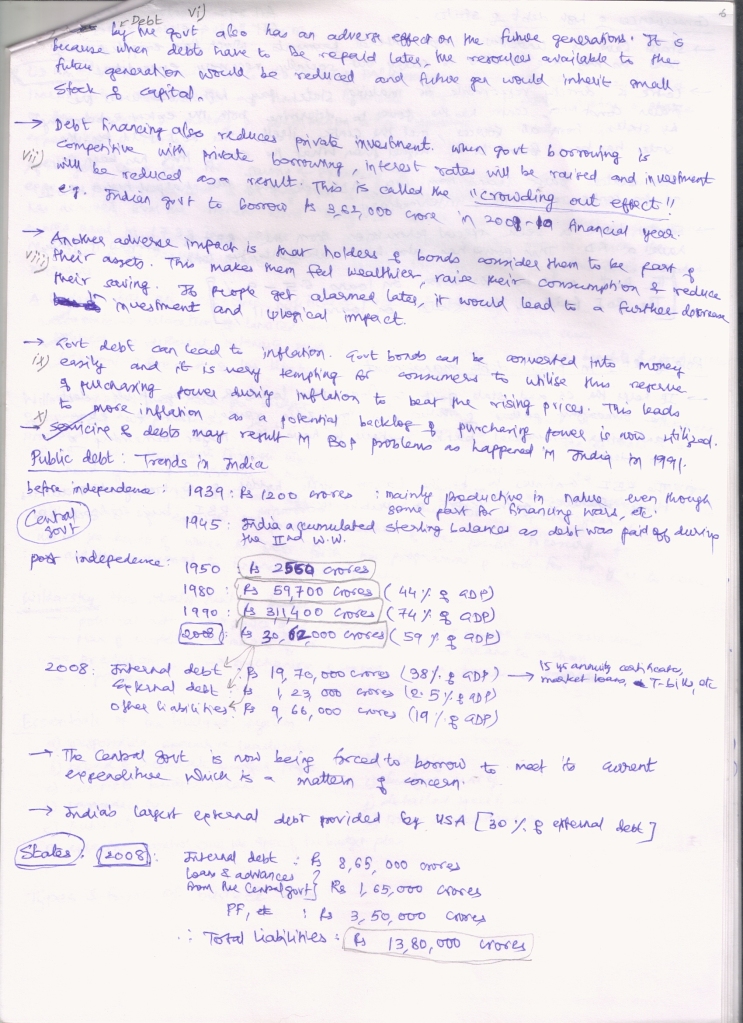

[Economy] 3 Methods of calculating GDP

Got this question from mail,

what are these income,production and expenditure methods in calulating GDP?how do terms like NNP, NDP, GNP,GDP,NNPFC,NNPMP DIFFER FROM EACH OTHER. what is difference between gdp at constant prices and current prices. its very confusing

I'll deal with each question in one post.

Earlier I had wrote an article on GDP, GNP,NNP,

anyways lets refresh the concepts again.

GDP (Gross Domestic Product) means,

Money value of everything you produce within your country.

(Domestic=within country).

Everything means products and services.

GNP (Gross National Product) means,

The Money value of everything you produce within your country PLUS your income from abroad. Anil Kapoor goes to America, get 5 million dollar$ to play baddie in Mission Impossible 4, but sends that money to India = counted in India's GNP.

But with same logic, Cricket Coach Gary Kirsten gets 50 lakh rupees from BCCI, and sends it to his family in S.Africa, you've to deduct it from India's GNP. (South Africans will count it in their GNP)

Similarly, Americans will subtract the dollar value of Anil Kapoor's remittance to India while counting their GNP.

So, what'll be the (stupid) formula?

Gross National production=Money value of everything produced within India+Incoming money from outside-Outgoing money to abroad.

Or you can simply say

GNP = GDP + incoming money from abroad - Outgoing money to abroad.

How GDP calculated and what is are these income, production and expenditure methods.

GDP is calculated by three methods.

Theoretically all three of them should give same final number, but in reality there will be slight difference between each of them.

#A: EXPENDITURE METHOD OF COUNTING GDP

Here you count the money spent by everyone.

So How to make a 'technical' formula? Ask yourself, where is the money changing hands? There are five components of that.

![Image Hosted by ImageShack.us]()

#1: CONSUMPTION BY PRIVATE CITIZENS [C]

like you and me buying (overpriced) daal, vegetables and milk (courtesy: Sharad Pawar).

I buy your second-hand bike for 15,000 Rupees, should we including it in the consumer Expenditure (C) ? Nope. Because the bike Is not 'produced again.

![[Image]]() |

| Second hand products are not counted |

When you had bought that bike for Rs.30000, 10 years ago, we had counted that money in that year's GDP. So second hand-product sale money cannot be counted in this year's GDP.

Now, I buy your second-hand bike from an auto dealer, (who gets Rs.1000 Commission) should we include it in the (C)? Hell Yes, because he sold his 'service' to me uniquely. Every time he sells a second hand product, although no new 'product' is created but new service is delivered by him.

WHAT IF SAME 1000 RUPEE NOTE IS CHANGING HANDS?

![[Image]]() |

| Each service or product has separate value even if same currency note is used to purchase it |

I gave a note of Rs.1000 to that dealer as part of his brokerage (dalaali) and he gives the same Rs.1000 note to the electricity company for his monthly bill.

Same Rs.1000 note is changing hands so is our GDP =Rs.1000? Nope. GDP is the money value of everything produced within India. So brokerage service is Rs.1000 separately and the electricity produced is also worth Rs.1000 separately. Therefore, Even as same 1000 rupee note is given to both parties.

Total GDP=1000 brokeage+1000 electricity bill=Rs.2000

If

electri.co gives that 1000 rupee note to its peon as salary, then again it has to be counted. Because peon sold his unique service separately to the company. So in that case

Total GDP =Brokerge+Electric bill+peon^' salary=Rs.3000

#2: Investment [I]

People investing in sharemarket, putting money in banks etc.

#3: Government spending [G]

Like buying (overpriced) sports equipment from Kalmaadi's associates during Common wealth games. Government paying salary to staff, buying new tanks and missiles..everything.

#4, 5 :Export & Import [X & M]

Money we get from export is added.

You remember that GDP means Money value of everything we produce within India. So if we import something, it has to be subtracted, because it is not produced within India.

So formula (for ease In remembering)

GDP = Consumer+Investor+Governer + (eXporter - iMporter)

Technically correct formula:

GDP(Expenditure)=C+I+G+(X-M)

#B: Income Method of counting gdp

Here you count everyone's income. But some people may be running business in credit (udhaari), sometimes payments are delayed. So may not give the 'full picture' for the given year.

#C: Production method of counting gdp

Total money value of everything produced (value added at each stage)

- Farmer produced Wheat and sold 100 kg of it @ 2000 Rs. (Original value)

- Flour mill, purchased it, grinded it and sold the flour to baker @ 2500 Rs. (+500 value added to previous purchase)

- Baker made breads, cookies and biscuits and sold the total production @3500 Rs to its final customers. (+1000 value added to previous purchase)

what is total 'GDP' here?

2000+2500+3500=8000 Rs? Hell no! You've to see the value added.

So, total money value of this line is: 2000+500+1000=3500.

Not all of the wheat goes into Baker's oven. Some of it will go in making beer, some in a normal household for making roti and so on. You've to track the value added in each different line.

To be continued... GDP at nominal price, Market price, Factor Cost, etc.etc.etc.